Raise your hand if a bank has shafted you

This is more a vent than an article. But I feel I must release it otherwise it will grow cancerous and spread amongst my healthy thoughts.

This is an open letter to Brian Hartzer – CEO of Westpac – but I know he’ll never read it. I’m sure one of his lackeys will file it in the recycling first. Read on, if you've ever been shafted by a bank.

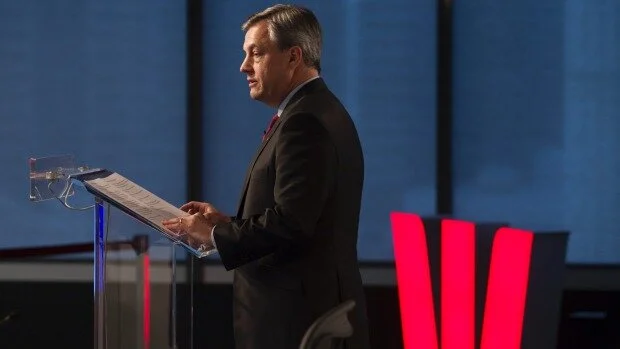

Image courtesy of smh.com.au

Dear Brian,

Today I cried on the phone. It was out of pure unadulterated frustration.

I have been a customer of Westpac for too long. I have moved through all your changes – Bank of Melbourne, St George – without complaint. I have borrowed money for houses and cars, had credit cards and savings accounts. I even worked for you when I was putting myself through university.

Last month we travelled to NZ. A long-awaited family holiday which we scrimped and saved for. At a NZ affiliated ATM, we withdrew money from our Bank of Melbourne card, selecting “savings” as the account to take it from. I am now told, the LINKED cards do not work overseas. Now, that I’m home and getting stung with bank changes every single month for the error.

Thing is, Brian. It’s not my error. It’s YOUR, very deliberate, billion dollar profit making error. You see, if people don’t know that an ATM withdrawal will be taken out as a “cash advance” when travelling, then you can make so much money and the laugh’s on them, isn’t it Brian?

We pay our credit card, in full, every month. We are your good customers. We don’t bring millions of bucks in for you but we do the right thing. We put our money in so you can invest it and make squillions off it while you babysit it for us, and we pay off any money we take out. As scheduled.

We never (knowingly) make cash advances on our card because we are very aware of the sting.

However, we were never told the withdrawal would be a cash advance – not by the bank when we linked savings and credit cards, not by the ATM when we withdrew the money, and not by the phone personnel when I rang day after day to query it. It took three departments, and three hours to report back to me what the charges were related to and even then the operator had trouble trying to explain why we would keep being hit.

And then the cream, even though we were charged a cash advance fee, plus an interest charge on that statement, and even though we paid that credit card statement IN FULL and ON TIME, we would have the pleasure of paying off the privilege of that cash advance for up to 18 months.

The only way out of this? To pay our credit card back to a zero balance. TODAY. RIGHT NOW. A month out from Christmas.

Know what would have saved 4 staff members’ time, and my anger and frustration? A little alert on the ATM when I selected “savings”. One that says “this account is not linked, please be aware this will be treated as a cash advance and will incur fees. Are you happy to go ahead?” in which case I would have said no.

But that wouldn’t help you make that line of profit, would it Brian?

So, thank you very much.

Should you be interested at all, find the poor guy, Ernie, who copped all my abuse and tears and yelling and swearing about what an abhorrent place you run there. Listen to me and my despair at an innocent error we will now have to pay for because your “system” is unable to reverse it.

Then, I guess you’ll shrug when I pull every single account out of Westpac and walk down to the local bank who supports the community. One who actually gives a rat’s arse about the people who help make their profit. Because why would you care as you bathe in bank notes and wipe your nose with diamond-encrusted tissues?

If anyone there is interested in customer service, please call me and tell me you have reversed the cash advance and put it through as a savings withdrawal, and we can all forget about this black day in banking. I’ll assume if I haven’t heard by anyone, that it is true, no-one at Westpac cares.

Sincerely,

Kylie Orr